What Norwegian investors should know about dividends and royalty payment

Analyzing the statistical information in Ukraine, as of October 1, 2017, foreign companies invested in the Ukraine’s economy up to 39 719 800 000 dollars USD. At the same time, part of the investment that was made by Norwegian companies is 7 200 000 dollars USD, which is about 0, 0181 %.

Over the past 20 years, there is a certain tendency of those Norwegian companies that are operating in Ukraine. For example, more often Norwegian companies start a business in Ukraine with the registration of their own companies (limited liability companies).

Limited Liability Company (LLC) is a legal entity that, on its own behalf, carries out economic activities for its profit and is liable for its obligations within its property (property liability).

It should be noted that the founders of the LLC may be both natural persons (individuals) and legal entities that are non-residents. There is no state registration fee for LLC, and the registration process takes only one working day.

Norwegian companies much less register their representative offices in Ukraine. The state registration of a foreign company’s representative office is conducted only in Kyiv at the Ministry of Foreign Economic Relations and Trade of Ukraine within 60 working days. The amount of the state fee: 2 500 dollars USD.

Dividend Payment to Norwegian companies.

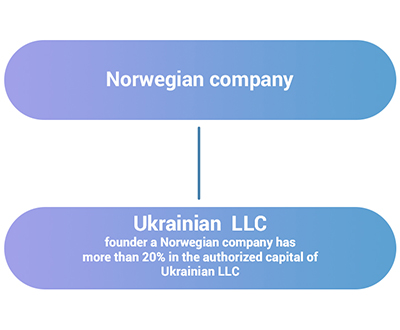

Norwegian companies, as the founders of Ukrainian companies, are entitled to receive dividends during the distribution of the share of profits of such legal entities.

In accordance with the provisions of the Tax Code of Ukraine: paying dividends (if a source of their origin is Ukraine), the tax rate is 15%, unless otherwise is provided by the provisions of international treaties.

In addition to this, there is the Convention between Government of Ukraine and Government of the Kingdom of Norway on Avoidance of Double Taxation and Prevention of Fiscal Evasion with respect to taxes on income and estate dated 07.03.1996.

According to art. 10 of the Convention, the tax rate that is charged in Ukraine from such income like dividends amounts to 5%, and should be paid by Ukrainian companies. But this clause applies only if the resident of the Kingdom of Norway owns at least 20% of the capital of the Ukrainian company, or has invested in the acquisition of shares or other rights of the company no less than 100 000 EUR. In all other cases, the tax rate is equal to 15%.

The reason to implement the provisions of the Convention while paying dividends is the certificate that confirms that the Norwegian company is a resident of the Kingdom of Norway.

In addition, Ukrainian company that was founded by Norwegian company has the right to reduce the dividend tax rate if the ultimate beneficial owner of such Norwegian company is a citizen of Norway and it should be confirmed by the relevant document.

2* Dividends received from Ukraine – 95 000 EUR

25% a standard dividend tax rate in Norway.

If international agreement on avoidance of double taxation is concluded tax rate is 15%.

5% dividend tax rate if the Norwegian company owns 25% of the share in the authorized capital of the Ukrainian LLC.

Ukrainian LLC decides to pay dividends in amount of 100 000 EUR

100 000 EUR Х 5% dividend tax rate in Ukraine = 95 000 EUR

Royalty payment to Norwegian companies.

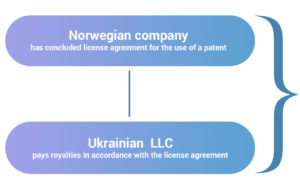

Also, the often usage of intellectual property right is observed in international practice. For example, a Norwegian company grants the right to Ukrainian LLC to use its trademark, by concluding a licensing agreement. Consequently, a Ukrainian company will be obliged to release payments for the use of the objects of intellectual property that are called royalties.

In accordance with the provisions of the Tax Code of Ukraine, the tax rate for royalty payment is 15%, unless otherwise is provided by the provisions of international treaties.

There is the Convention between Government of Ukraine and Government of the Kingdom of Norway on Avoidance of Double Taxation and Prevention of Fiscal Evasion with respect to taxes on income and estate dated 07.03.1996.

So according to art. 12 of the Convention – a royalty may be taxed in Ukraine if the receiver, who is a benificial owner of the royalties, is a resident of the Kingdom of Norway, the tax so charged shall not exceed: a) 5 per cent of the gross amount of the royalties paid for the use or the right to use any patent, plan, secret formula or process, or for information (know-how) concerning industrial, commercial or scientific experience; b) 10 per cent in all other cases.

The reason for the implementation of the provisions of the Convention is the certificate that confirms that the Norwegian company is a resident of the Kingdom of Norway (the actual recipient of the royalties). In case of absence of such certificate at the time of payment the income of a non-resident (Norwegian company) is taxed in accordance with the legislation of Ukraine at the rate of 15%.

In addition, the Norwegian company should confirm the actual copyright to obtain royalties. There may be such confirmations documents as license, patent, trademark certificate of registration.

Royalties received from Ukraine – 95 000 EUR

0% royalty tax in Norway

Royalties = 100 000 EUR

100 000 EUR x 5 % royalty tax in Ukraine = 95 000 EUR

It’s worth mentioning that from November 14, 2017, due to the decision of the National Bank of Ukraine, the possibilities for paying dividends abroad in a foreign currency have been extended. The monthly limit on such operations in 2014-2016 makes to no more than 5 million dollars USA. The regulation of the procedure for paying dividends to foreign companies for 2014-2016 brings a slight liberalization of the investment climate in Ukraine.

Information is prepared by

Law Company “Lex Consulting”

2018